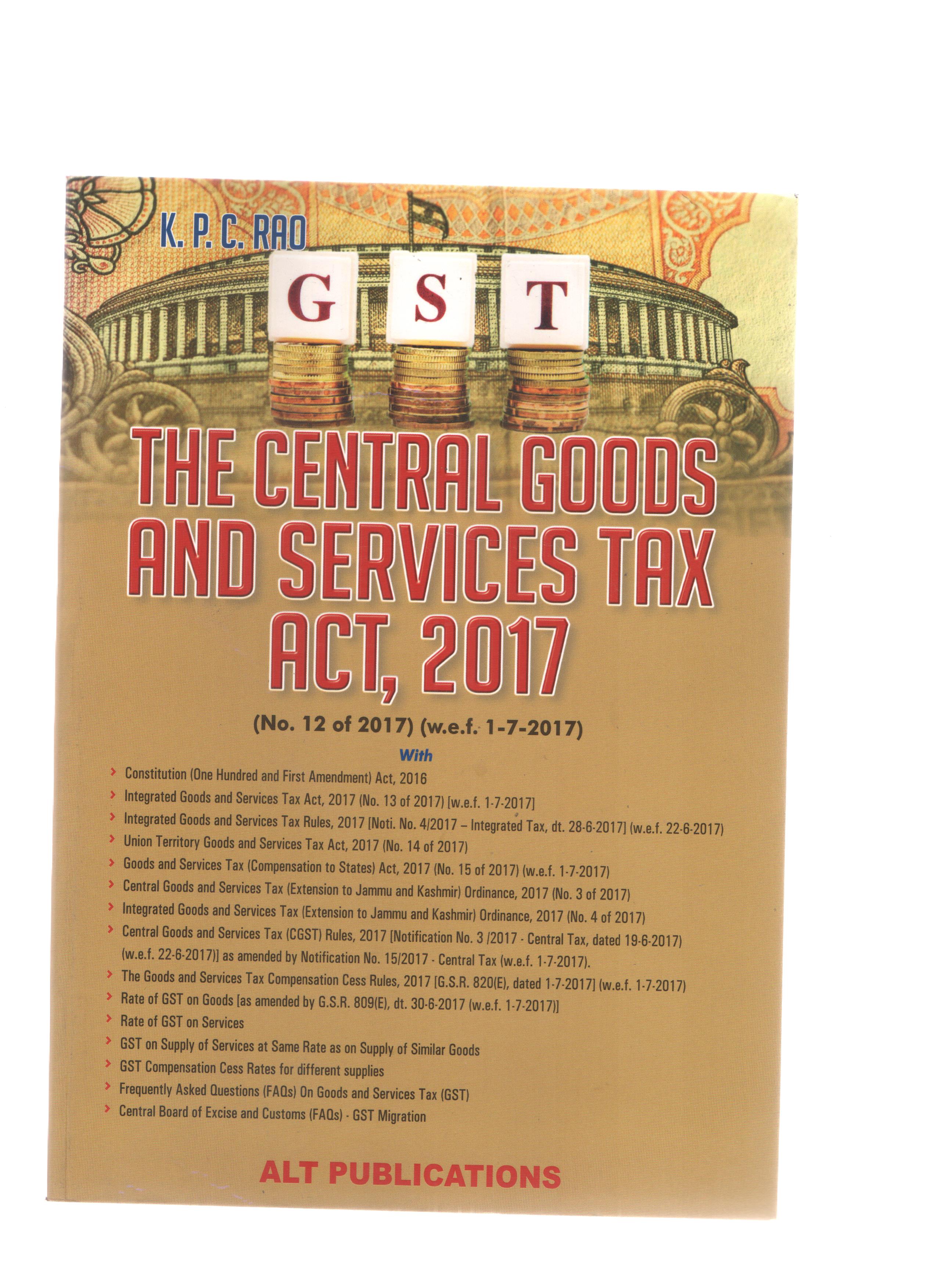

Author -

Code - 9788183952064

Binding - Paper Pack

Page No - 938

Edition - 2017

Price - INR

1170.00 819.00

Goods and services tax (gst) one of the most radical tax reforms in the history of indian economy , has been effective from 1 july 2017. GST is an indirect tax and applicable throughout India which replaced miltiple cascading taxes levied by the central and state governaments.

The genesis of the introduction of GST in the country was laid down in the historic budget speech of 28 february 2006, wherein the then fianance minister laid down 1 april, 2010 as the date for the introduction of GST in the country. Thereafter, there has been a constant endeavor for the introduction of the GST in the country whose culmination has been the introduction of the constitution (122 Amendment) bill in December, 2014.

Amalgamating several central and state taxes into a singal tax would mitigate cascading or double taxation, facilitating a common national market. The simplicity of the tax should lead to easier administration and enforcement. Introduction of GST would also make indian products competitive in the domestic and international markets. From the consumer points of view , the biggest advantage would be in terms of a reduction in the overall tax burden on goods, free movement of goods from one state to another without stopping at state borders for hours for payment of state tax or entry tax and reduction in paperwork to a large extent.The GST is governed by a GST council and its chairman is the finance Minister of india.

Constitution (One Hundred and First) Amendment Act, 2016

The assignment of concurrent jurisdiction to the centre and states for the levy of GST would require a unique institutional mechanism that would ensure that decisions about the structure, design and operation of GST are taken jointly by the two. This issue has been addressed by the introduction of the constitution (One Hundred and first Amendment) Act 2016, following the passage of constitution 122 amendment bill.

Info Will be updated soon